|

Click here or scan to pay your property taxes

- First Half Payment - Due April 30

- Second Half Payment - Due October 31

|

USPS Postmark Changes - Please Read

The U.S. Postal Service no longer guarantees same-day postmarking when mail is

deposited. Mail is postmarked when it reaches an automated processing facility,

which may occur after the due date. Under RCW, property tax payments must be

postmarked by the due date to be considered t imely. To avoid late fees, do not wait

until the last day to mall your payment.

|

2026 Property Tax Statements are currently being processed and will be in mailboxes before the end of February

|

|

|

For payments by phone, please call 1-866-791-3392. A $3.95 convenience fee will be charged by our processor in addition to 2.35% debit and credit cards and $1.00 for checks.

Welcome

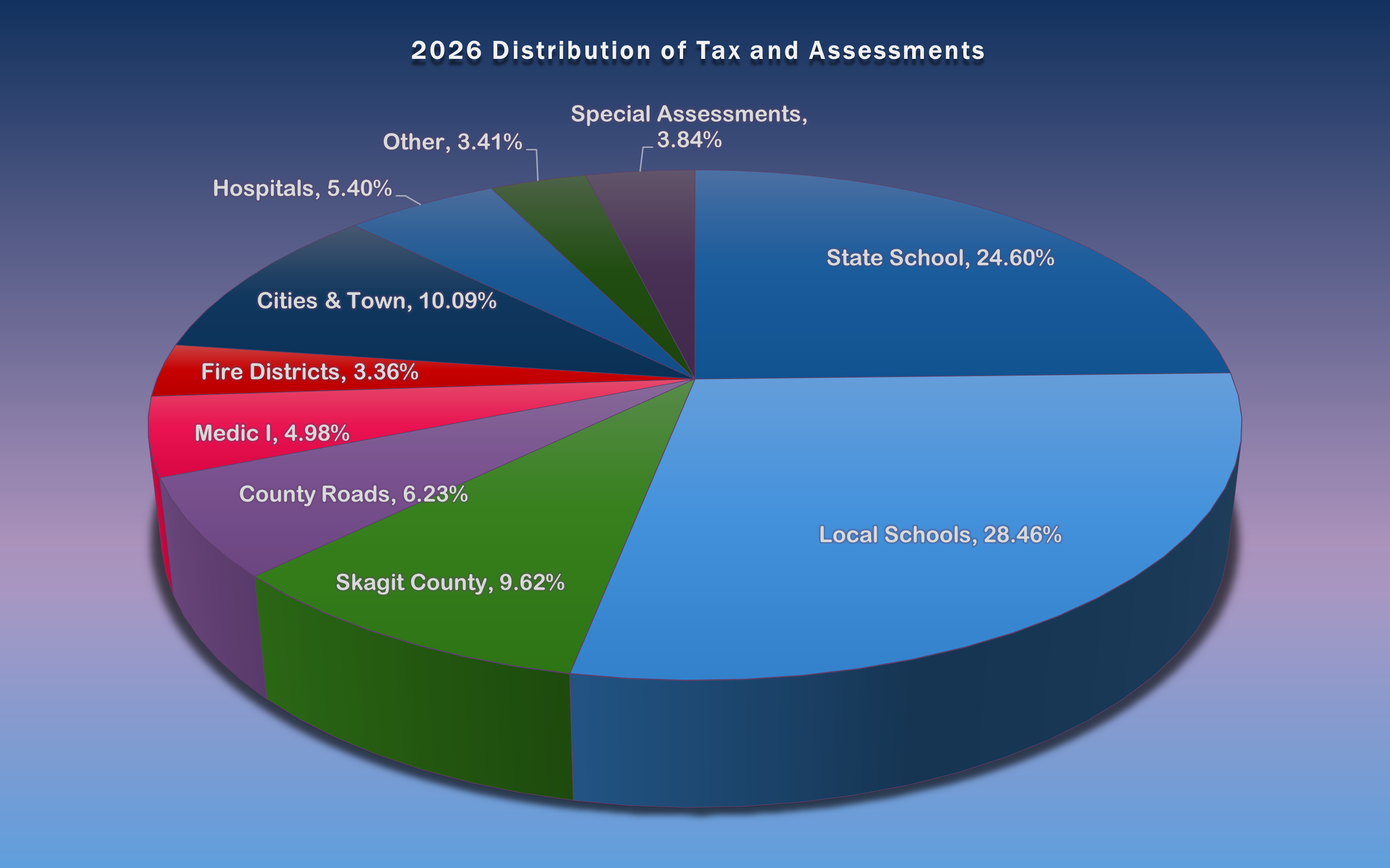

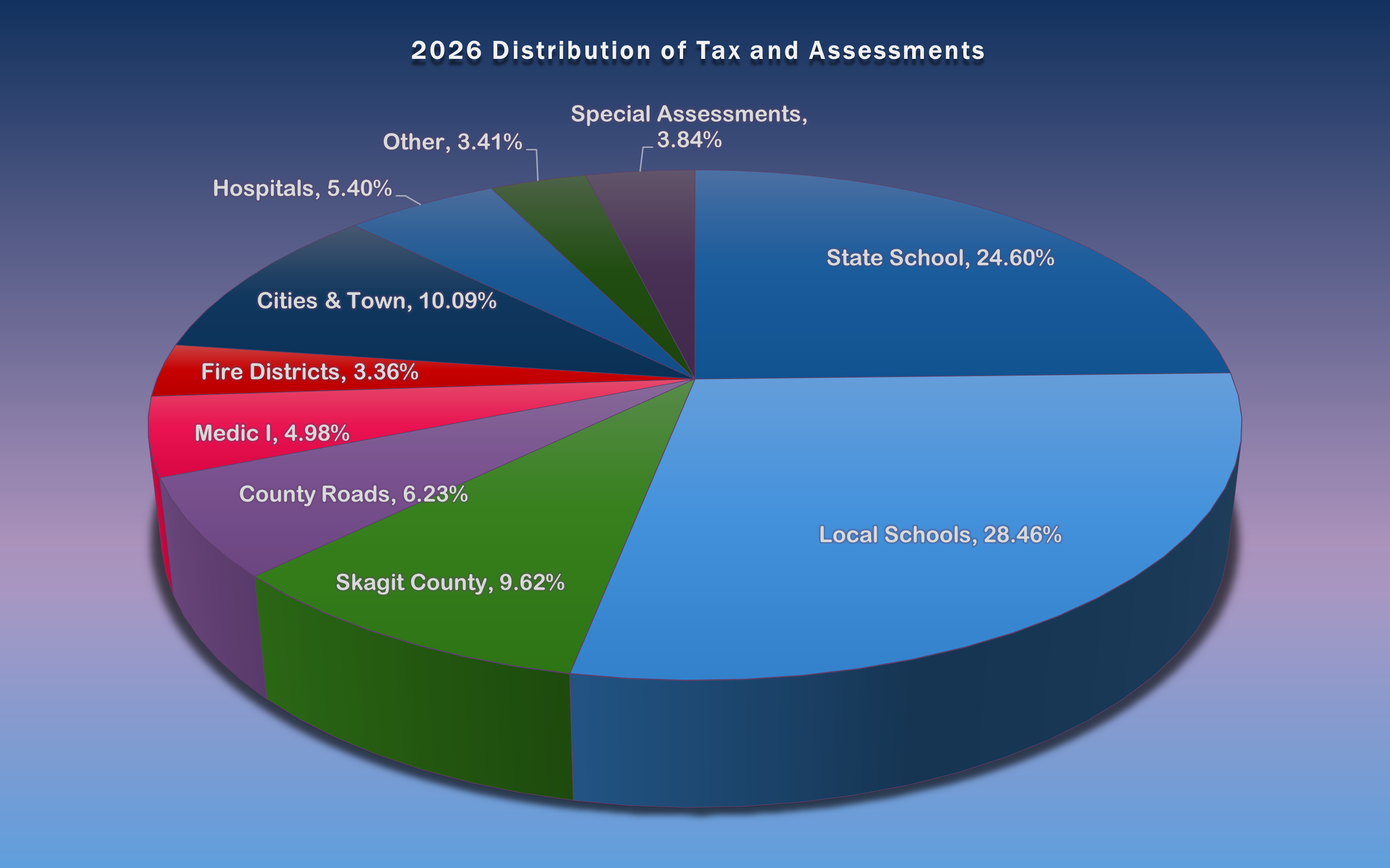

The Skagit County Treasurer’s Office is a regional office serving about 80 local government districts. We operate under state law to provide cash custody, investment, revenue collection, and debt payment services to those districts.

Our Mission Statement

To safe-keep and manage public funds while equitably providing honest and respectful customer service.

In carrying out our responsibilities, our goal is to provide the highest quality of service and professionalism.

General Taxpayer Information

Property taxes are due when billed, however, there are two final dates that tax payments must be received. If you choose to split your property taxes into two installments, the first installment must be received by April 30 and the second installment must be received by October 31. If the property tax is less than $50.00, the full year must be paid by April 30. (RCW 84.56.020)

Late payments are subject to interest and penalties (RCW 84.56.020). Interest is assessed on the full year tax amount due, beginning May 1. Please contact our office at 360-416-1750 for the correct amount due if you are paying late.

The Skagit County Assessor sets values on property, establishes levies, and approves tax exemptions. Please contact the Assessor's Office for more information 360-416-1780.

|

Property owners have an opportunity to sign up for e-Statements.

The information on how to sign up for this service is included in your property tax statement.

Additionally, the Treasurer’s Office offers a convenient auto-pay program that automatically withdraws their tax payment on the due date. This is available to taxpayers at no cost and takes the worry out of missing a payment.

How to read your Property Tax Statement

Address Changes Only

Is your address correct? Address changes may be made in any of the following ways:

Our office has two drop boxes for tax payments:

- One located at the base of the stairs in the ‘U’ shaped parking lot.

- The second drop box is located on the wall outside our office doors. Our drop boxes are checked daily.

- If a receipt is needed, please include a note or write on your payment envelope you would like a receipt and one will be mailed to you.

- Should you have a cash payment, please come into our office and one of our staff members will assist you.

Other payment options available on our website:

Real Estate & Mobile home Ownership Transfers – Phone: 360- 416-1769

Skagit County Treasurer employees want to serve the public in the most efficient manner. Some of our services can be easily transacted without physically coming to the office.

- Taxes may be paid online with a check or a credit card. There is a $1.00 fee for checks and a 2.35% fee associated with credit cards. You may also make arrangements with your bank to pay or simply put a check in the mail.

- Excise transactions may be sent through the mail. More information for excise can be found under Department of Revenue Washington Administrative Code 458. For questions on excise, please call 360-416-1750.

- Many questions can be asked by emailing treasurer@co.skagit.wa.us or looking online.

- Questions about exemptions for a reduction in taxes can be answered by calling the Assessor’s Office at 360-416-1780.

|

CONTACT US

Physical Location:

700 S. 2nd Street, Room 205, Mount Vernon, WA 98273

Office Hours

Monday – Friday 8:30 am – 4:30pm

Mail:

Skagit County Treasurer

PO Box 518

Mount Vernon, WA 98273

Phone: 360-416-1750

Email: treasurer@co.skagit.wa.us

|

|